Illinois Set For Fuel and Tobacco Tax Increases

June 18, 2019 |

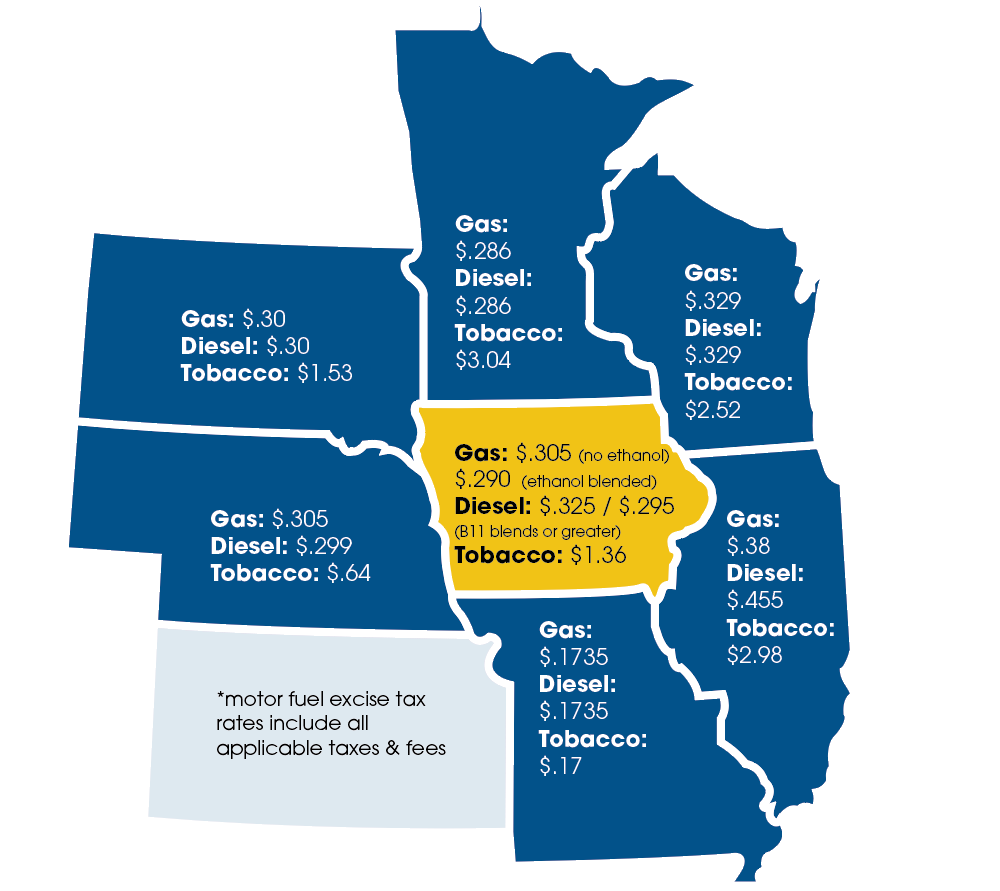

The state of Illinois is set to implement a series of excise tax increases that may impact FUELIowa members located on the eastern side of the state. On July 1, the Illinois’ tax rate on petroleum products increases to 38 cents on gasoline and 45.5 cents on diesel. Additionally, Illinois will also implement a $1 increase to their tobacco tax rate making the total effective tax rate on tobacco products in Illinois $2.98. On July 1, FUELIowa members will also see an excise tax rate change on gasoline that is not blended with ethanol. On July 1, the excise tax rate for gasoline will decrease from 30.7 cents on gasoline to 30.5 cents. The excise tax on ethanol blended gasoline will remain unchanged at 29.0 cents.

For a comparison of Iowa tax rates with neighboring states, see figure below.

.png)

.png)